When you invest, you use money you have, called your principal, to buy assets that have the potential to increase in value, provide regular income, or do both. As you accumulate these assets — typically stocks, bonds, and mutual funds — your net worth and your financial security grow.

Liberty Bank

Many people still do not understand the importance of money investing. Hence, I thought of writing this so illustrate the importance of it.

There are 2 main reasons why we need to invest our money:-

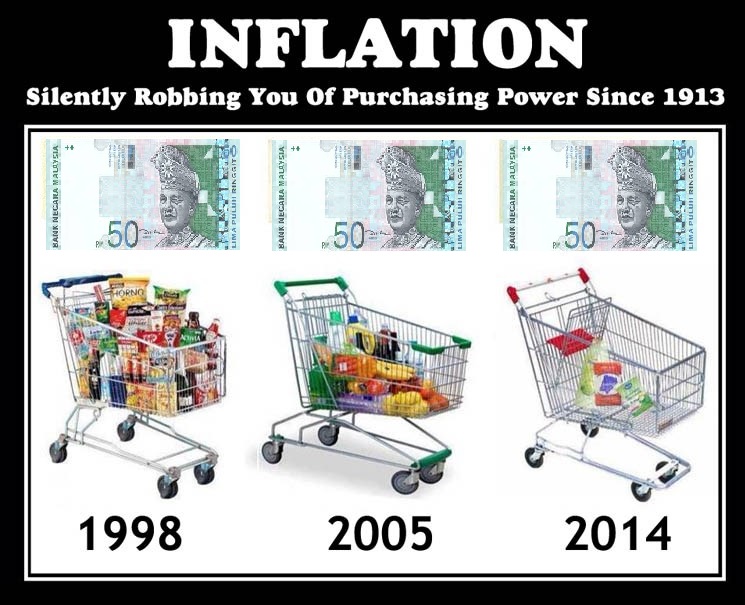

REASON 1: We need it to fight against INFLATION

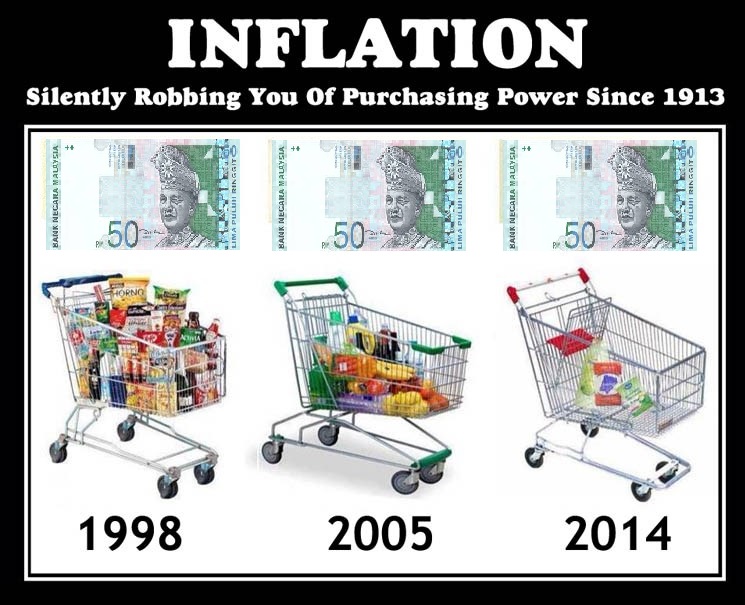

Inflation is a general increase in prices and fall in the purchasing value of money. It is best illustrated via the following picture.

In year 1998, with RM 50 you could buy a trolley of things in the shopping mall. In year 2005, your RM 50 was enough to buy only half trolley of things. In year 2014, you could only buy a number of things with RM 50.

This clearly shows that your money is shrinking over years. But, do you realize that your salary does not increase in the same pace as the inflation? If you do not invest your money, you are very likely to be poorer and poorer when time goes by.

A lot of people still think that Fixed Deposit (FD) can help them to fight with inflation but it, in fact, cannot. The average inflation rate in Malaysia is about 3% but the current FD rate is lesser than 3%. It shows that in order to fight with inflation, we need an investment vehicle that is higher than inflation.

REASON 2: We need it to increase our WEALTH

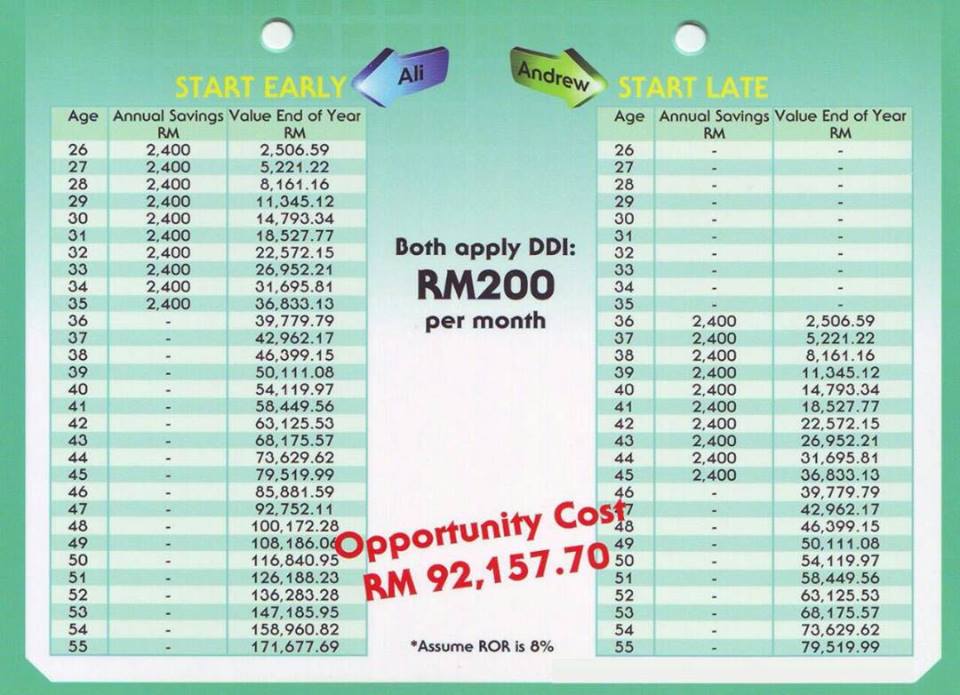

Everybody likes to be financially free. There will be no one like to work for money forever or still prefer to work due to money when they are old. Hence, wealth accumulation and wealth acceleration are important and they should be started as young as possible.

Wealth accumulation: If wealth is accumulated in young age, there will be plenty of time left to accumulate enough wealth for retirement. If the process is started late, it will be more difficult to accumulate enough wealth at a shorter period of time.

Wealth acceleration: With inflation, the wealth accumulated will decrease over time. To increase wealth, we need to invest our money in the investment vehicle(s) with higher return.

***********************************************************************************

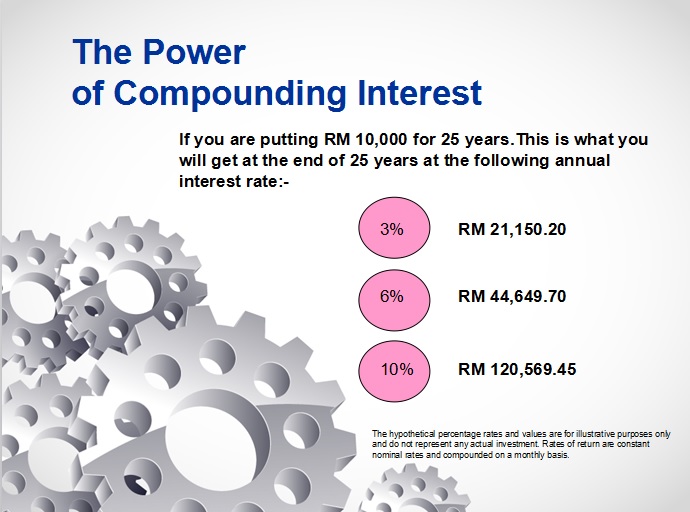

The above 2 reasons are well illustrated by the following table. See the effect of investment on your money after 20 years.

Can you see the effect? With 5% annual inflation, your RM100,000 actually shrinks to RM 35k+ after 20 years. If you continue to put your RM100,000 in the Fixed Deposit that provides you 4% return (bear in mind that average FD rate is less than 3% now), your money will also shrink to RM 81K+ after 20 years.

However, if you choose to invest your money in investment vehicles that give higher return that the inflation rate. Your money starts growing, and it means your wealth increases over time!

***********************************************************************************

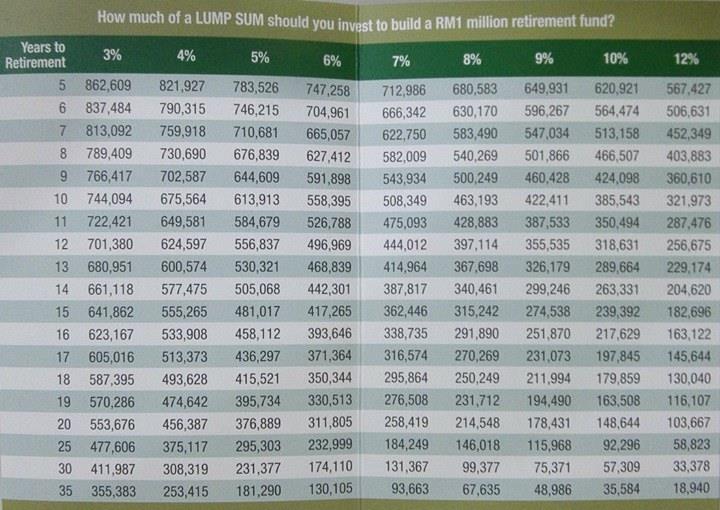

Now we do another stimulation on consistent wealth accumulation, saving RM 1,000 a month for 20 years.

See the effect? If you have 20 years, RM 1,000 can generate RM 413K+ for you in 20 years, assuming you invest in a investment vehicle that gives 10% return annually.

***********************************************************************************

Some people will think that they make a lot of money and hence they don’t think they need to do investment. But…..

“It’s not how much money you make, but how much money you keep, how hard it works for you, and how many generations you keep it for.”

Robert Kiyosaki

In conclusion: START ACCUMULATING YOUR WEALTH (SAVING) and START INVESTING so that your wealth will increase and not decrease.

There are several investment vehicles that can help increase wealth, i.e. shares, unit trust, properties, etc. I shall discuss this in greater depth in the future posts.

******************************************************************************

I’m happy to connect with people who are interested in investing topics. Connect with me via Facebook and text me “Happy Investing!”. You can also subscribe to my Telegram channel to receive weekly newsletter here.