How does inflation affect your personal finance?

At this fast-pace era, we cannot immune to inflation. See the inflation rate for Malaysia from official source of statista.com.

In 2020, due to pandemic, the inflation rate went to negative for the first time in past 30 years.

However, based on what you have experience as a consumer, do you feel the things are getting cheaper? If you are looking from the consumer’s perspective, you will only notice things are actually getting more expensive, especially our food. The real consumer inflation rate has not dropped but only rised. The food we are eating now is double in price compared to 10 years ago. If we consider the price of things will double in every 10 years, the real inflation rate is 7.2%.

How does this inflation rate affect our personal finance? Well, first of all our fixed deposit saving rate is at all times low, if our inflation is keep going up, our money saved in our fixed deposit will reduce in value over time which deteriorate our purchasing power. Because of the low fixed deposit rate, if we choose to save our money for our retirement, we have to work extra hard to get more income so that we can save even more to cope with the inflation.

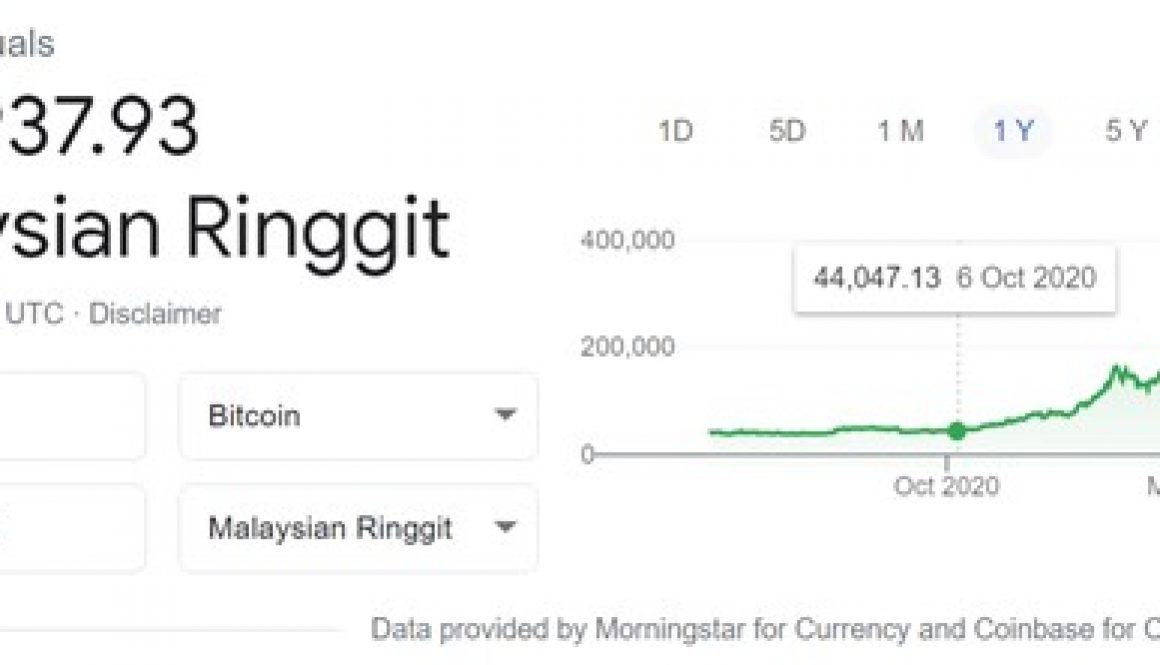

Secondly, the investment vehicles that we deployed got to be higher risk than usual. Putting our money into bond might not be a good choice as most secured bonds have return less than 4% per annum. More proportion of investment in equities are required to balance out the inflation risk. Perhaps the investment portfolio needs to consider more growth element, e.g. technology sectors, emerging countries, rather than conventional stable equities like big banks, consumer discretionary sector.

Thirdly, we got to re-consider the withdrawal strategy during retirement stage. It is required now to reconsider slightly lower our lifestyle requirement during retirement stage as the living expenses are now higher than expected. We need more capital to generate return to help us go through the increased living cost during retirement. Either we need to have extra income during retirement or we need to lower down our retirement lifestyle to ensure adequacy of our retirement fund. In conclusion, inflation does have a lot to do on our personal finance planning. We need to start planning early to avoid the risk of inflation affecting our golden years at the later stage. When we have more time before retirement, we can let the time to do the magic of compounding interest. When we are too late to plan, we got to take even higher risk during our retirement.

************************************************************************

You can receive constant broadcast message relating to wealth creation to financial freedom through Telegram. Click here to subscribe to the telegram for the weekly newsletter.