The Power of Compounding Interest

“Compound interest is the eighth wonder of the world. He who understands it, earns it … he who doesn’t … pays it.”

― Albert Einstein

The key principle to note when investing is “the principle of compounding”. Put in its simplest terms, the phrase compound interest means that you begin to earn interest income on your interest income, resulting in your money growing at an ever-accelerating rate. It is the fundamental of growing your wealth and anyone can take advantage of the benefits through a disciplined investing program.

This blog post shall be read in conjunction with setting your financial goal in order to select the most appropriate investment vehicle for you.

***********************************************************************

2 Things That Determine Your Compound Interest Returns

There are two things that will influence the rate at which your money compounds. They are:

- The effective interest rate – When calculating the effective rate, tax rate and the inflation rate shall be taken into consideration for accurate calculation. The higher the effective rate, the higher will be the total return;

- Duration of investment – The longer you invest your money, the bigger your money grow.

***********************************************************************

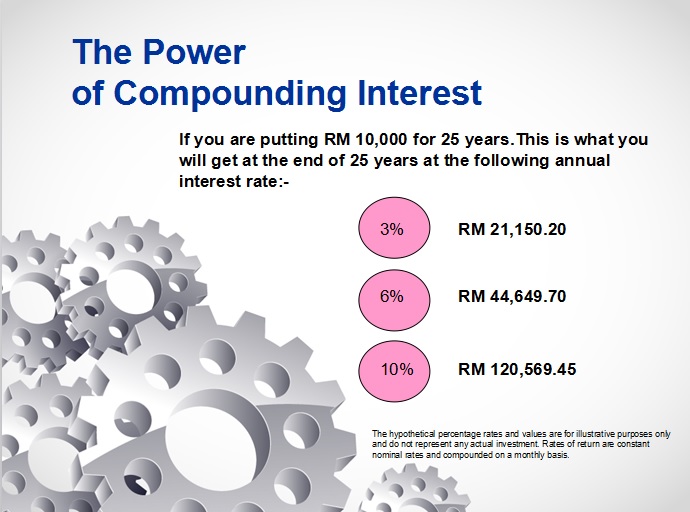

INTEREST RATE: This following picture shows the impact of the interest rate:

For a monthly investment:-

See the impact of compounding interest? A regular saving of RM 100 per month for 25 years, totaling at RM 30,000 grows to RM 132K+ at 10% (a total difference of RM 100K+).

For a lump sum investment:-

A lump sum investment of RM 10,000 grows to RM 120K+ at 10% (10 times growth after 25 years)!

**************************************************************************

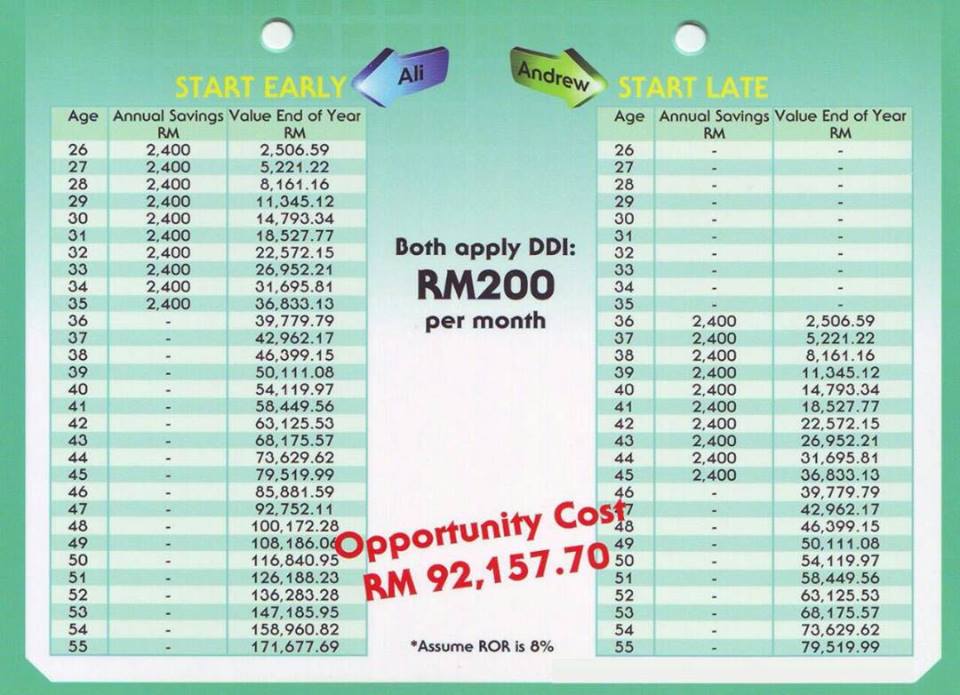

DURATION OF INVESTMENT: This following picture shows the impact of the duration of investment. The earlier the investment is made, the better it is. Ali invested RM 2,400 per year for 10 years at the age of 26, his money grows to RM 171K+ when he is 55 years old. On the other hand, Andrew invested the same amount of money but starting at the age of 36 (10 years later). His money grows to only RM 79K+ when he is 55 years old.

**************************************************************************

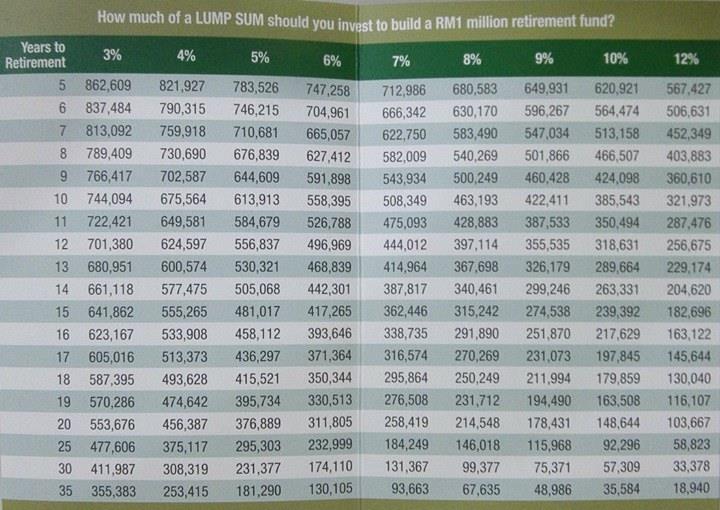

Hence, to achieve our financial goal, it is important for us to know how long period we have for investment and to select investment vehicle that generate the required interest rate. The sooner you start to save, the greater the benefit of compound interest.

To check how much of a lump sum should you invest to build a RM 1 million retirement fund, see the picture below:-

Happy investing!