What is the best financial decision I’ve made so far?

I was asked this question during my recent training session. As I was thinking about the answer of the question, lots of memories flashed through my mind, and I remembered my investment journey with my husband.

My husband and I came from a middle-class family. We were not poor but we did not have extra cash to buy luxurious things. We only had enough to survive. Those who know us think we are thrifty. Sometimes, people just feel that we are too careful in spending. Yes, this is our nature and probably it is partly due to our profession as Quantity Surveyor. We are sensitive to cost and money as we do cost control in our job. We don’t spend on things that are unnecessary and do not give value or return.

I first came across the word “investment” when I was 16 years old from Robert Kiyosaki’s book – “Rich Dad Poor Dad”. In fact, the book belongs to my mum and had been kept on shelves for sometime until I was asked by my English tuition teacher to read various types of English books to improve vocabulary. I can still remember that I chose “Rich Dad Poor Dad” simply because it was the only book with big font, which I thought it would be easier to read and faster to finish reading. Haha! However, I did not finish reading the book. Through the first few chapters, I got the idea that I need investment to grow rich!

Unfortunately, even though I knew investment is important for wealth growth, I only started my first investment in year 2006 with Public Mutual.

As I continue with my journey of wealth accumulation, I started to equip myself with other investment information. I started to explore other options explained by Robert Kiyosaki, i.e. properties and shares. I bought my first property (for own stay) in year 2008 and my first share in the same year.

Now nearly 10 years has passed, my husband and I have already accumulated quite a number of paper assets and properties. Although not all our properties make money, most of the paper assets are in gain. With our consistent and structured way of investment, we are able to balance out our risks and make consistent long term return.

Our net worth has grown unconsciously through these investments. Let’s look at my unit trust funds as an example. I started off with only RM 1,000. With forced regular savings and returns over the years, the account has now grown to RM 80,000++ without much effort.

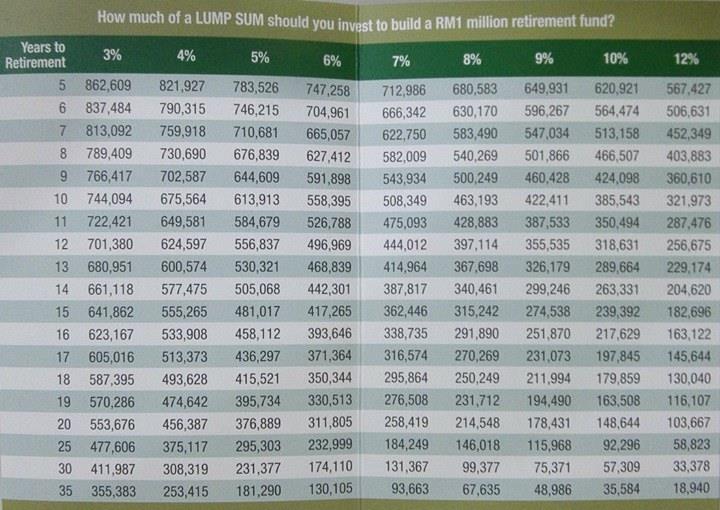

With the RM 80K+ in the unit trust, we are now looking for ways to increase its current return so that it can grow to RM 1 million in 20 years time. This money will be the education fund for our kids. We are consistently looking for other opportunities to diversify and grow our wealth.

If we did not realize how important structured investment is in wealth growth, we would never have started the investment journey. Thanks to Robert Kiyosaki who taught me this.

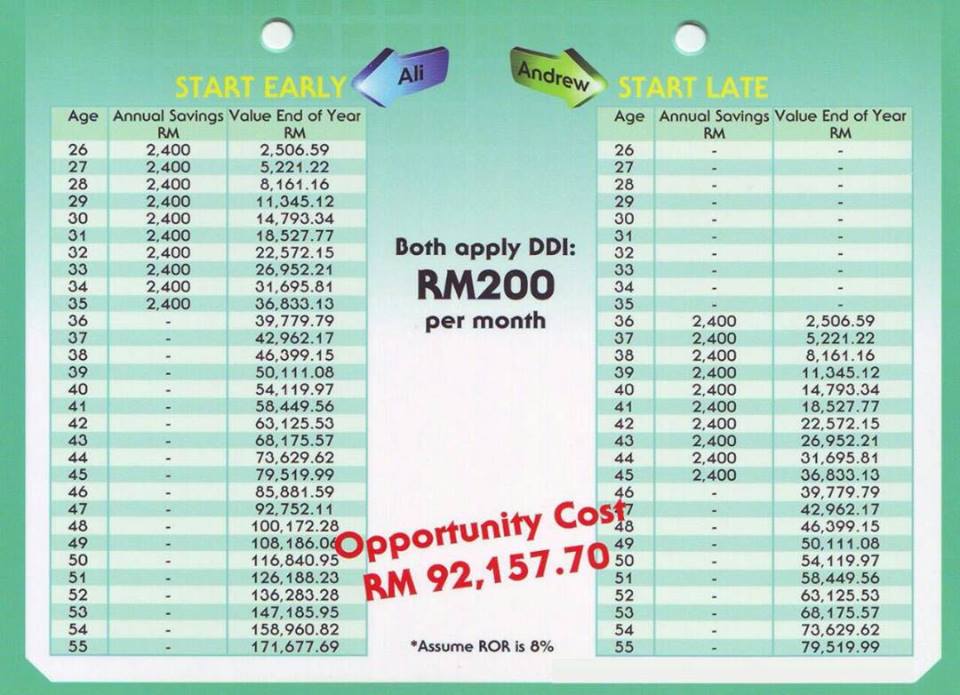

What is the best financial decision I’ve made so far? It is to have started investing in my early twenties and I’m so glad I’ve explored various investment vehicles all these years. as I started investment earlier, I’ve got the chance to encounter failures and problems that enabled me to rectify / change strategies earlier before it is too late.

I know it comes with risk and a lot of people have warned me about the risk. I’m afraid of risks too. However, what I learned so far is that investing requires disciplines and diversification. With the correct strategies and discipline, it can generate long term return.

“We don’t have to be smarter than the rest. We have to be more disciplined than the rest.”

Warren Buffet

I’m sure everybody needs to know about investment to achieve their financial goal. If you have not started any investment, do it as soon as possible as late investment comes with opportunity cost.

I’m happy to connect with people who are interested in investing topics. Connect with me via facebook and text me “Happy Investing!”.

Happy investing!

**********************************************************************************

Further reading:-

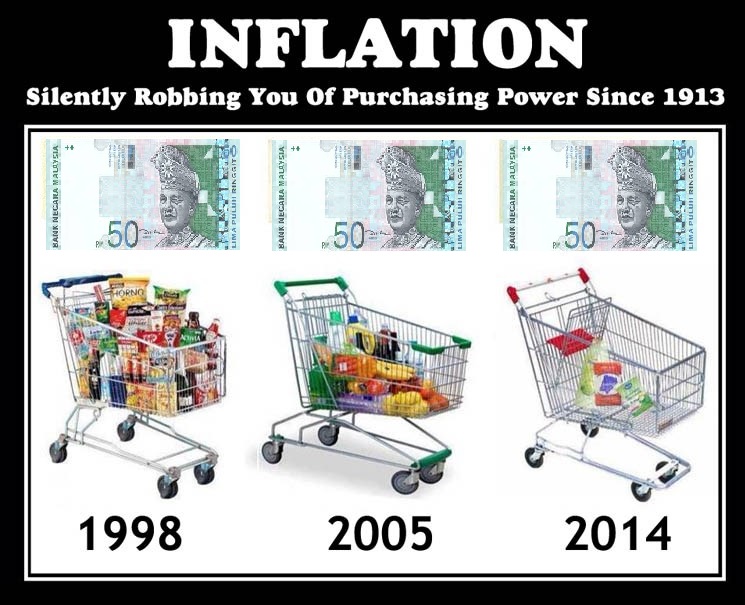

- Why it is important to invest your money?

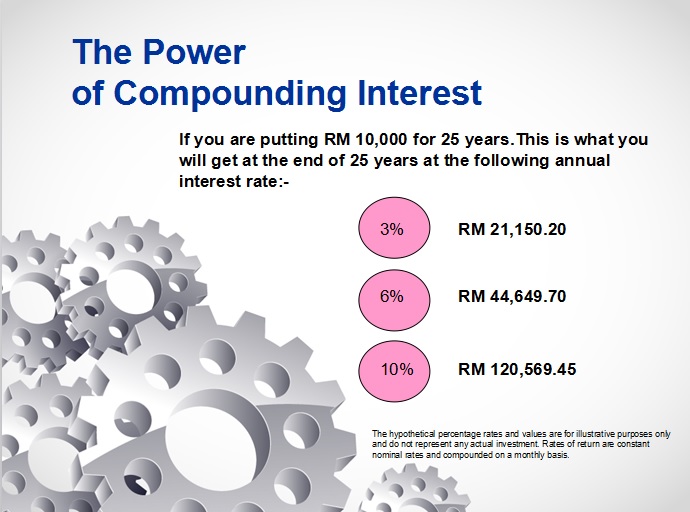

- The power of compounding interest

- Why investing in unit trust?